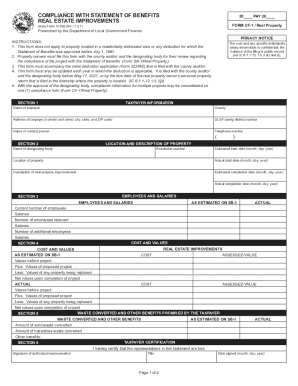

IN Form 51766 2023-2025 free printable template

Get, Create, Make and Sign indiana form 51766

How to edit form cf 1 re online

Uncompromising security for your PDF editing and eSignature needs

IN Form 51766 Form Versions

How to fill out form real estate improvements

How to fill out IN Form 51766

Who needs IN Form 51766?

Video instructions and help with filling out and completing indiana state form 51766

Instructions and Help about compliance statement real estate

Music ladies and gentlemen commissioner her an and the state of the county address good afternoon I am honored to present the 2018 state of the county message to the residents of Seminole County and as always we are very grateful to the chamber and to its sponsors for once again producing this incredible event well we've come through a challenging year here in 2017 if 2017 proved anything it's that this county is strong, and it's strong because its people work together at all levels the people of this County make us proud they have faith in themselves, and they have faith in each other time and again in 2017 they demonstrated their uncommon decency their courage the resourcefulness and even their love 2017 certainly presented many challenges it delivered the most severe wildfires we've seen in 20 years it presented us with our worst hurricane in 14 years we continued to battle the public health crises posed by Zika and the evil scourge of opioid addiction chaplain I got to tell you at that particular point I was referencing scripture to find out what might happen next locusts famine frogs drumming it falling out of this guy but now what was next has sent us over 300 Puerto Rican families and as our school board will tell you they came complete with 490 schoolchildren and Counting but through it all we continued to thrive we didn't just survive we continued to thrive because we work together whether it be in times of challenge or crisis celebration or joy in 2017 we work together as a community because we know by working together that makes us stronger our cities in Seminole County make us stronger our seven cities here in Seminole are wonderful places to live they are continually listed at the top of every kind of survey about best places to live in the country, and they have great employees working for their governments this year there are public safety and first responders work seamlessly together and with the county to meet all the challenges of 2017 and Seminole cities have great leadership if you are a mayor or a city manager or council member or commissioner from one of our cities please stand and be recognized thank you so much you are great partners Public Health and Safety remain at the forefront of our County's priorities we are very fortunate to have an excellent partnership with the Florida Department of Health Seminole County's Public Health Officer is Donna Walsh Donna please tell us Donna please tell us what Seminole County Department of Health has been doing this year to make us stronger Seminole County ranked as the fourth healthiest county in health outcomes in the state of Florida in 2017 this designation will not have been possible without the amazing partnerships taking place in our County through collaborations the health of Seminole County residents and visitors has improved in priority areas such as increasing access to care addressing chronic diseases access to mental health services and reducing infant mortality we...

People Also Ask about indiana real estate improvements

How long can you go without paying property taxes in Indiana?

How can I lower my property taxes in Indiana?

How do I apply for property tax exemption in Indiana?

At what age do you stop paying property taxes in Indiana?

What happens if you don't pay your property taxes in Indiana?

How do I file an extension for business electronically?

Is there a cap on property taxes in Indiana?

How late can you be on property taxes in Indiana?

What does DLGF mean?

How does Indiana assess property value?

Can I electronically file an extension?

When can you appeal property taxes in Indiana?

What type of value is generally greater than the assessed value?

How do I file an extension and pay electronically?

How do I appeal property taxes in Indiana?

Do senior citizens get a discount on property taxes in Indiana?

How do I appeal a notice of assessment?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit statement benefits real estate on a smartphone?

How do I fill out the indiana form 51766 compliance statement form on my smartphone?

How do I edit 51766 statement benefits improvements on an Android device?

What is IN Form 51766?

Who is required to file IN Form 51766?

How to fill out IN Form 51766?

What is the purpose of IN Form 51766?

What information must be reported on IN Form 51766?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.